WC Colin: Super Moon over City of London, UK Tax avoidance and evasion are promoted unofficially by governments in order to stimulate the domestic employment market. A means of placating the mob. One seventh of the money in circulation is now held in offshore accounts for the purpose of reducing tax. That's US$26,000,000,000,000 in places like the Isle of Man, UK Channel Islands, Luxembourg, Amsterdam in Holland, Turks & Caicos, Belize, Virgin Islands, Cayman Islands, Bahamas, Monaco, Zurich in Switzerland, Liechtenstein, Delaware in USA, etc. As with many of the trouble spots in the world, many of the 'troublesome' tax havens were set up by HMG. Most of this money is not invested in seed companies and other global economy boosting projects. Instead in these uncertain times it is invested in safe areas such as precious metals, artworks, vintage cars, expensive homes, hotel chains, football clubs, etc. In short, the global economy is not expanding enough, which is why commodities such as oil, steel, ship charters, etc. have reached rock bottom. This has not surprised me in the slightest, because since BNP Paribas exposed the sub-prime mortgages scandal coming out of New York in August 2007, I have been monitoring the world's financial market forces, wondering how and when the final coup-de-grace will take place, because I do not believe that a WT coupled with the end of capitalism will come about before then.

The lack of money to invest is also caused by distrust between financial institutions, initially sparked by sub-prime mortgages, that is good mortgages mixed up with a lot of bad ones, with distrust continuing through the everlasting PPI (payment protection insurance) scandal where banks took out insurance, often without their customer's knowledge, when they acquired a credit card or took out a loan or mortgage. The Libor inter bank rate fixing scandal resulted in few prison sentences, but did irreparable damage to the City of London's integrity. The City of London, or docklands as it is also known, is the financial district built during the boom years.

My personal pension lost half of its value as a result of the dot com boom and bust. When I became sixty-five I cashed it in because I could not stand the stress of owning this worthless bauble. Once a year HMG reminds me of this venture in a letter telling me what my 'indexed linked' pension will be in the next financial year, by deducting money from my state pension, money that I am theoretically earning from this cashed in private pension. I get the feeling that HMG only wants people to have a personal pension so that it can be deleted from your state pension when you retire. Does that sound familiar. You get paid with one hand and it's taken away from you in the form of income tax, national insurance, value added tax, community charge, commuting, tools & protective clothing, training, etc. with the other. The lack of job security and low real wages for the peasants, means that people are less mobile. Fewer homes are being bought and sold, except of course by the rich doing their money laundering in London.

WC Dick Thomas Johnson: Tokyo Stock Exchange, Japan With HMG promoting women's lib and gay marriage, less children are being born, so exclusive family ventures do not take place, and therefore do not stimulate the economy. With more people living on their own, this places a greater strain on the housing market. With more migration, this places increasing costs on our legal, social housing, health and education systems. Increasing taxes to cope with this, whilst tax revenue from the economy falls, is not a situation that any government wants to be in. Employment has risen in the UK to its highest level recorded. Much of this is because people can no longer afford not to work, due to falling welfare benefits. Reductions in corporation tax have attracted employers to this country, often at the expense of jobs in other parts of the EU. Due to the closure of GTC's (Government Training Centres) and Skillcentres by HMG in 1988, many of these new jobs tend to be low skilled and hence low in tax revenue. Higher education courses tend to be out of date, incomplete and nothing more than a taster. Not what employers want. As a result three quarters of the UK economy comes from the service sector, particularly from the City of London, where many graduates do not even have a degree from a recognised university.

Another cause of the slow down in the global economy is the fact that there is a limit to how much people want to buy. I only bought a smart phone in 2018 because my previous mobile phone died on me. I don't really need it. It sits by my pillow in case of emergencies. As for the broadband internet service, at 240 pounds p.a., plus a TV licence at 154.50 p.a. (2019) it's barely affordable. The truth is that the global economy is not expanding fast enough in order to absorb the full production capacity of automation in the manufacturing sector. When one compares the economies of India and the PRC, the latter is far better managed and vibrant. India's agriculture, retail system and transport infrastructure are a shambles. For a country that builds nuclear power stations and can send a space probe to Mars, that is really saying something. The reason is simply because the government in India, unlike that of the PRC has failed to re-educate its people into the modern age. In effect it is hamstrung by traditional thinking.

In the meantime countries like the PRC and those in Central Asia are running out of money to finance capital projects due to a slowdown in manufacturing demand and falling oil / gas prices on their exports.

Of course the natural gas price keeps falling, but the bills keep rising. That's capitalism. In August 2021 however, the trend reversed, possibly due to government manipulation.

WC Rehman Abubakr: International Finance Centre, Hong Kong As economists and government treasury officials meet in places like Davos, Switzerland, it's plainly obvious that there is no simple solution to the highly complex problems in the global economy, and certainly no quick fix. Despite the billions of dollars in fines handed out to banks, the very thought that some rogue trader or loose cannon is out there, haunts the system, a system where super computers engage in the buying and selling of millions of stocks and shares each day with little human control, and even less understanding.

Competition in the global economy has forced many people to go off shore, because in the UK in particular there are few permanent jobs. Amongst professionals in particular, jobs are on a contract basis. I worked for forty companies over a period of twenty years, almost all of which was on a contract basis. At first one could work continuously through an agency from one contract to another. Eventually as the economy outside of the City of London declined, one became self employed because you were spending more time looking for a contract than actually working, in engineering. Eventually HMG forced the self employed to become limited companies. The last major contract I did was off shore through the Isle of Man. If it was not for that six month contract I would have had no money to furnish the rented flat I moved into afterwards, and would then have had to sleep on the floor for years. That was back in 1989.

Twenty-six years later tax avoidance has become a bit more complicated, but not much. It is known as a remuneration trust. In addition to you in the UK, the Dutch sandwich consists of a daughter company registered in Amsterdam and a company in the Isle of Man. Setting up a company can cost say 390 pounds plus an annual fee. There are about fifteen thousand companies registered like this in Amsterdam worth a total of 8,000,000,000,000 pounds. Earnings are transferred to these companies, 'costs' are deducted leaving the tax man, in my case HMRC (Her Majesty's Revenue & Customs) with a few breadcrumbs.

WC GPA Anthony Quintano: One World Trade Center, New York, USA Needless to say it's the hard working honest employee that now makes up the loss in government revenue from these offshore ventures. HMRC is currently turning a blind eye to what is going on since HMG is no doubt fearful that Russian oligarchs and Arab sheiks will relocate their funds elsewhere. The fact is that in almost all democracies, parliament represents the people, whilst government represents business, including their own, that of the financing of political parties. The UK tax regulations now occupy twenty-three thousand pages that few people understand fully. I think that my regulations could easily fit on just one page.

1 In the case of purchases from the general public (not a limited company) the VAT is paid to the government of the country where the buyer is located at the time of purchase.

2 Businesses set up for the sole purpose of avoiding tax will be ignored by HMRC.

3 In the case of purchases from business to business the VAT is paid to the government of the country where the buying company is at the time of purchase.

4 In the case of corporation tax, it will be based upon turnover, not profit, and will be at the rate of 10%. Any company that does not pay this bill within twelve months will be shut down, its assets sequestrated, whilst its branches abroad will be barred from trading in the UK.

5 Director's pay that is more than four times the salary of the lowest paid employee within that company, will be taxed at the rate of 100%. Does not apply to the companies founding members.

6 Any disputes will go to trial by jury, where the jury members will be all considered working class, owning homes costing no more than 200,000 pounds. Legal aid will not be available.

7 Industrial robots, androids and AI will pay income tax at a rate comparable to half that paid by human workers that it replaces, or could replace.

WC Zairon Manama: Bahrain World Trade Centre & Harbour Taxing companies on their turnover not profits, will hopefully encourage diversification.

Company shares should be retained for at least seven years in order to maintain stock market stability and give a chance for seed companies to mature and generate profit. It will be illegal to purchase shares, bonds, commodities through loans. The use of credit cards will be banned.

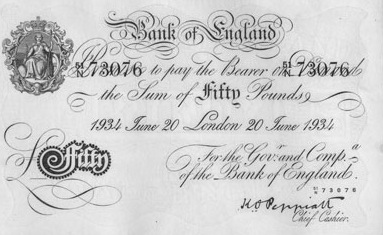

I have only borrowed once, and that was for a home I eventually lost. I do not believe in borrowing. In addition to traditional banking and growing competition from peer-to-peer lending via the internet, there is also dealings in electronic money like bit coins. I have never used them. Unlike SPEVs, which is a payment in kind system, rather like a supermarket voucher, bit coins on the other hand are negotiable, rather like tokens offered to their workers by industrialists during the industrial revolution in the UK. This means that they have a value relative to traditional currency which can go up or down. It therefore beggars the question, how do you maintain confidence in the virtual banking system? Traditional banks had large bronze doors and ornate columns to create a reassuring atmosphere. Most modern bank buildings lack even that. And of course, since 1971, currencies have not been linked to the gold standard. Then the US dollar was worth $35 per ounce of gold. Today an ounce of gold costs $1888 (January 2021), a dramatic devaluation of the dollar and all other currencies linked to it. In a world where ledgers have been superseded by blade servers, preyed on by associated malware introduced by villains and the anti-capitalist movements, its difficult to see how confidence in the global economic system can be maintained, particularly as it is also being manipulated by political forces. I am of course referring to quantitative easing, which is simply a way for governments to get out of debt by printing more money.

WC Lidongyun: Using Electronic Currency With A Debit Card The future of course lies in some form of electronic based reward system. In the United States Facebook's LIBRA waits in the wings. In the PRC the DCEP (Digital Currency Electronic Payment) system is about to render the US dollar a secondary global currency. There are millions of Chinese living abroad whom the People's Bank of China hopes will promote this idea. Like Bitcoin, the DCEP is a blockchain currency, but unlike bitcoin it is centrally controlled by the state. DCEP comes with an electronic wallet called novi and a digitized ledger to verify transactions. If you lose your wallet, then the chances are that the People's Bank of China will have a backup, unlike bitcoin. However, a centralized government backed system is regarded as a subtle means to spy on people. What is to stop the government making you yuanless in a split second? A SPEV goes beyond cryptocurrencies. You cannot steal it, because it's worthless to anyone else. It's no good to misers, because you cannot save it. It is designed for one purpose only, namely to improve the quality of life of the beholder and their dependents. Unlike the competition, it can drastically reduce crime and ill health, particularly mental. It will maintain an egalitarian civilisation. Advances in information technology, particularly artificial intelligence and facial recognition ensure that SPEV's are the best alternative to all other forms of reward. There would be no borrowing nor commodity speculation, making it acceptable to Islamic believers. Since no one would actually own anything, the need to borrow to buy land and equipment for say a major construction project, would simply not arise. Under this system my hovel could be demolished and replaced with a home fit for the twenty-first century in a fraction of the time it previously took under capitalism. In effect our present economic system is holding back progress. Since there are no lightning transactions, stocks, shares, commodities, futures, insurance, pensions, it is a more stable economic system. In the event of a pandemic therefore, there would be no hesitation in shutting down the global economic system. It is the logical choice by those who want the ideal world, a utopian dream.

Currently DCEP is planned to be introduced in 2021, whilst the US administration concentrates on other matters, like impeachment and buying off the Iranians, as the Bank of England continues to search for its lost 50 billion pounds of British currency. Is it a money laundering passport, being hoarded by thousands of Chinese people who do not want an electronic currency? What does it take to get our pen pushing western politicians to create anything great? It's plainly obvious to me that there needs to be a meeting of all nations to decide what global electronic financial system, including laws, we all need to sign up to in this age of organized crime, corruption, tax havens, money laundering, speculation, lightning computers, global communications and quantum physics. Blockchain can also be used as a foundation for other secure databases.

WC Zairon: Art Science Centre & Marina Bay Financial District in Singapore There are also problems with insurance. Try and get insurance on a price comparison website and the chances are that these insurance companies don't want to do business with you. Hundreds of them simply don't want to know. This is because of your criminal record. Whilst insurance companies will provide vehicle insurance to just about anyone, that is not the case with home and home contents. One third of adult males are being treated this way. Now as I understand it, an insurance company is one that takes on risk in return for money. But when I apply having only committed two offences over thirty years ago, I get nowhere. Since my sentence was more than three years, under the 1974 Rehabilitation of Offenders Act, it has not lapsed. I've never committed an offence involving money. So since the UK insurance industry is not prepared to take on risk, can they be trusted? I'm willing to bet that many insurance policies are invalid because of non-disclosure of criminal records, and the insurance sector deliberately withholds that information. One in four insurance claims are not paid out because damage was caused through lack of maintenance. How do you know that the insurance company (and its governing body) you are handing hundreds and in some cases tens of thousands of pounds to, are legitimate and fair? As far as I know there is no list of such financial institutions on a HMG web site. We no longer live in villages where everyone knows who can fix you up.

So where are the compulsory life study classes to teach you everything you need to know about technology, communications, financial systems, etcetera? When the final global financial crash occurs there will be one body you can blame more than any other........government. There they will be, standing shoulder to shoulder in Downing Street. Prime minister and chancellor, saying what a hectic day it was and how it was all unforeseen. That we should not worry. That it will all come out in the wash. But of course, it won't.

For UK ex-cons you can find help with insurance through the NACRO and unlock.org.uk websites. Be prepared to spend up to four times more than your neighbours.

When you look at all the problems in the global economy don't you wish you were being paid through a system you could trust, namely SPEVs. Capitalism has been largely OK whilst the need for it has lasted, money has been in existence for the last two thousand years, whilst banking came from the Moors and Knights Templar of the middle ages, but it's now time to move on.

WC kees torn: EVER GIVEN Container Ship

Infamous for blocking the Suez CanalUnfortunately there appears to be a large number of seemingly intelligent people in financial and IT circles who simply do not know what a currency is, never mind SPEVs. They support the use of cryptocurrencies, of which there are now believed to be about one thousand. Let me remind you of what a currency is. A currency has to have the following virtues:

1.... It needs to be managed by a central bank, which will tend to all those unforeseen problems, usually associated with its value. The central bank must ensure that the coins and bank notes cannot be counterfeited. It must also ensure that strict computer procedures are adhered to, to prevent online fraud.

2.... It needs to be supported by a government, which manages the economy that its value is linked to. A currency is worthless to traders if its value continually fluctuates wildly.

3.... The banks that trade in that currency need to manage it to a high professional standard, in order to instil faith in its value by the user. It must be readily available, supported by cost effective services. Its security system must be infallible.

4.... There must be a regulatory body and police commercial branch, approved by the government, to monitor in house and external security.

So called cryptocurrencies fall a long way short of these standards. They are therefore not currencies, but a fantasy in the minds of people looking for a Star Trek economy. I get the strong feeling that they are being conned by others, who are determined to make a killing from associated high priced trading. Those not committing fraud may still be considered culpable. This is more than just pyramid selling, for it has the capability to bring down the global financial system if left unchecked. Generally it is an algorithm that no one appears to take responsibility for, so how it can end up on the futures market, I simply fail to comprehend. Cryptocurrency exchanges go out of business after experiencing cyber attacks, whilst exchange managers get kidnapped. Just where is the global financial system heading? In the real world, Monopoly money is worth more than Bitcoins. Cryptocurrencies are therefore not currencies. They are not commodities. They are no more than gambling chips on a roulette table where you don't even know the odds of winning. It is an occupation for idiots, motivated by greed with total disregard for the consequences. There are probably one million people involved in what amounts to an act of terrorism. Unfortunately as politicians just sit there and look the other way at the Covid-19 pandemic, gambling is becoming dangerously close to replacing the real world economy.

In 2019 Facebook announced that it intended to introduce its own cryptocurrency called Libra, to roll out in 2020, supported by at least 21 major companies. This plan has received intense criticism from bankers and politicians alike, which leads me to suspect that some of these schemes have been set up by intelligence agencies looking for a quick killing in order to finance black projects, whilst others are set up to undermine the economies of certain countries.

Why has this happened? It's because the established banking sector is not providing adequate competing services, particularly in the third world where bank branches are sparsely located. This is slowing down the development of the global economy, which is not a good thing. Cryptocurrencies recognise no frontier, and are, for the moment, untraceable. They appeal to villains and migrants alike, embarking upon money laundering. It is the duty of banks to cater for the needs of the masses, and not to generate potential economic chaos, simply by sucking their thumbs, or demanding personal identity papers where none exist. I can well understand their refusal to embrace block chain technology, since they don't have to. They can use there existing mobile phone based internet banking technology.

WC Bank of England: In 1900 the pound sterling was worth US$5

Now worth about US$1-50, due to series of bad government & business decisions.With government treasuries now considering the introduction of negative interest rates, this will merely encourage more people to invest in cryptocurrencies. As governments muscle up to one another over the Russian invasion of eastern Ukraine and the removal of civil liberties in Hong Kong, the rug is being pulled out from under them by a looming global economic collapse caused by Bitcoin & Co. It is likely therefore that governments will simply acquiesce to the demands for cryptocurrencies and legalise this pyramid selling scheme globally, just as HMG gave in to pirate radio in the 1970s. They are also likely to compensate these 'investors' with a lucrative exchange rate when they switch to a global electronic currency, just as the West German government did with the East German currency on unification. Corruption pays, simply because there is absolutely nothing the electorate is going to do about it. If I was a gambler, I would say that this conspiracy was started by the CIA. Will it create WWIII, or some kind of Bladerunner hell hole? In the end, a world technocracy replacing money with SPEVs may prove to be the only acceptable solution, when the global financial system has crashed, due to too many hesitant fingers in the pie. Will top politicians and bankers be arrested over their inaction?

WC Bell Telephone: Debt v Currency Depreciation With SPEV's there is no inflation, no get rich quick schemes or cons, and it can incentivise, such as the special offer of a super deluxe holiday for those who maintain a low carbon footprint, etc. There are no doubt many people out there who think that SPEVs are just another form of slavery. Well think about this; in June 2020 the Bank of England announced that it had finally paid off all its debts associated with the compensation of slave owners within the British Empire. That arrangement was agreed by parliament in the The Slave Compensation Act 1837, four years after the Slavery Abolition Act became law. The twenty million pounds, 5% GDP, compensation took 182 years to pay off, long after mechanization was introduced into plantations, and long after most of these plantations were shut down. No slaves were compensated, whilst the company owners and employees that committed crimes against humanity were rewarded, instead of being sent to prison for life, or the gallows. At the end of the eighteenth century you could buy a slave for just sixty pounds. These days employers get them for nothing, for they are called employees. That may sound an exaggerated statement but in the UK a director earns as much in three days as an employee on the shop floor earns in one year.

In 2020 the top one per cent of households now own 23% of the UK nation's wealth. That's 800 billion pounds, and it's all down to Margaret Thatcher's monetarist policy which no government since its creation in the 1980's has had the honesty to repeal. Scrapping wages' councils was equivalent to scrapping the Slavery Abolition Act. Drastically lowering the top rate of income tax at that time, in order to stimulate investment by entrepreneurs, was an abject failure, judging by the huge amount of money the Bank of England cannot account for in 2020. Politicians say that our debtor nation has been created by automation and AI, but the truth is that it has been created by our totally corrupt political and financial system. Coupled with the undermining of trade union power through laws, and the breaking up of large utility corporations, in order to reduce the effectiveness of strike action, plus reductions in welfare benefits, the UK has now become the perfect arena for a subtle form of forced labour, which no British government has the slightest intention of changing. Basically it means that the average politician doesn't give a damn about improving the quality of life of their constituents. The battle between employment and the leisure orientated society is therefore likely to be long and bloody.

So just how and when will the global capitalist system finally bite the dust? Well in my opinion it won't be soon enough, although the consequences are likely to be unbearable to watch. If one looks at the paralysis within governments and police forces over cryptocurrencies, its plainly obvious that they are a liability, unable to even quantify never mind desist this universal ethereal. They can't even police the internet because they simply don't understand it. Cryptocurrencies are a confidence trick perpetrated by those that create them, manage them, supply office space and IT hardware and software, and advertise such services. Utility suppliers should also be charged, particularly for electrical power which crypto miners now consume at a faster rate than the citizens of Argentina. They must all be arrested and charged with theft, fraud, economic sabotage and hence ecological crimes. The most obvious cryptocurrency is of course bitcoin. With Elon Musk's Tesla motor company giving the green light by investing in bitcoin using spare cash, it doesn't take much imagination to visualize investors in company stock switching to the magic coin, resulting in the collapse of the world's stockmarkets. Since I'm not an economist I have no idea where that would lead to, but I'm certain it ain't good. Would it make the entire financial system worthless? How long would it take to readjust? And readjust to what? Would it bring down governments and trigger WWIII? So what's the solution?

WC Jorge Franganillo: Cryptocurrency is not a currency

It is a speculative medium

supported only by greedIn July and September 2019 the president effectively legalised cryptocurrencies. That's what the website says and it's correct. But it's the president of Uzbekistan. If he was your bank manager wouldn't you want to change banks? It's obvious to me that all those involved must be arrested and executed. Organisations must be heavily fined and in some cases shut down permanently. Owing to the apathy of politicians there are now at least one million villains involved in this con. There is no prison large enough to house them, and not enough court facilities to give them a realistic trial. Execution is therefore the only practical solution. To let this problem become so huge clearly indicates that politicians have abrogated their responsibility to the electorate for years. Therefore they are plainly unfit for public office. Since human beings can no longer be relied upon, the entire internet, including the world wide web and the dark web must be policed by AI. The AI would take out all websites engaged in illegal activities, and update security, HTML, CSS, script standards on other websites to web 3.0. Cryptocurrency traders and their customers digital wallets would be barred from trading on the internet and from trading in approved electronic currencies. Further down the line it would also remove propaganda, non-maintained outdated websites and correct data. All data would be made semantic. This would of course require an international agreement, which is unlikely to come from Russia and the PRC if accusations of interference in US elections and industrial espionage are correct. This problem is far greater than Covid-19 pandemic and yet the media say almost nothing about it. Is there a conspiracy amongst western governments to trash the world's established economic system? Why hasn't the media got the determination to expose this? What happened to investigative journalism? Haven't they got the write stuff? The press should be the bastion for democracy, but the word appears to be no more than a metaphor for apathy. They just don't wanna rock the boat. THIS APATHY MUST END NOW.

In April 2021 President Biden announced his intention to double capital gains tax from 20% to 39.6%. This immediately caused Bitcoin to fall ten per cent in value. This plan is believed to be coordinated with other developed countries, to put an end to cryptocurrencies, as the developed economies move towards electronic currencies. Will there be a global electronic currency, instead of global war? Wishful thinking.

An alternative to the above scenario is as follows. Just how secure is your money in that bank vault and on that bank's computer database? In 1859 occurred what is now known as the Carrington event. A giant Coronal Mass Ejection or solar flare consisting of billions of tonnes of plasma in a magnetic field, hit the Earth causing telegraph poles to ignite around the globe. If such an event happened today it would knock out almost all satellites, telephones, power stations, emergency generators, ships, aircraft, road vehicles, including those traversing deserts, lost because GPS would probably no longer be working. I say probably because being a military system, it should survive. Computer databases will also fail, including those in libraries and financial institutions. Agricultural systems especially those used in hydroponics will also cease working. All these electrical systems will overheat and burn out due to the increase in induced electrical power. In military terms it's called electro-magnetic pulse. And if you think it couldn't happen again, may I remind you that in 2012 the Earth narrowly missed another such attack. Prior to this was the Quebec, Canada national grid blackout 1989, which knocked out the supply, causing the overhead power lines to freeze, become overweight with ice, and collapse. Six million people were affected by this during the winter. Most of the electrical systems mentioned here are not protected because of the cost involved. That factor exists because of capitalism, namely the importance of competition. Electrical systems can be protected by placing them inside Faraday cages, or if they are physically too large, then they are switched on to earth. To replace the planet's power station transformers would take years, at the end of which people would be so use to using SPEVs they wouldn't want to know any earlier system.

In June 2023 the Bank of England announced that nine billion pounds of old twenty and fifty pound notes had not been returned, following the switch to plastic bank notes. They had not been legal tender since the previous October, although they could be exchanged at a bank. In addition eighty-seven million pounds of old one pound coins had still not been handed back since they had been superceded by the two metal version. in addition inflation was going through the roof. Global prices were still high one year after the end of the lockdown, although it had gone on one year longer in the PRC. New employees in accounts' departments were still reluctant to engage in competitive pricing of their products and services. Food inflation had now hit 19.1%, whilst mortgage rates were approaching 6%, due to the central bank raising base rate to 4.5%. It was doing nothing to reign in inflation. Instead it simply made low paid workers more determined to get a realistic pay rise. Rail workers, junior doctors and nurses were engaged in industrial action, whilst there simply weren't enough bus drivers to provide a proper service. In my opinion, raising base rate was a class action. Simply a way of clawing back the pay rises the working class were receiving from their employers. As for the employers, higher rates meant substantially less investment, and ultimately less tax revenue. The only country that appeared to know what it was doing was Japan. It had negative interest rates in order to encourage people to invest in government guilts and company shares.

Ideas 29...The Global Economy

.jpg)

.jpg)

.jpg)