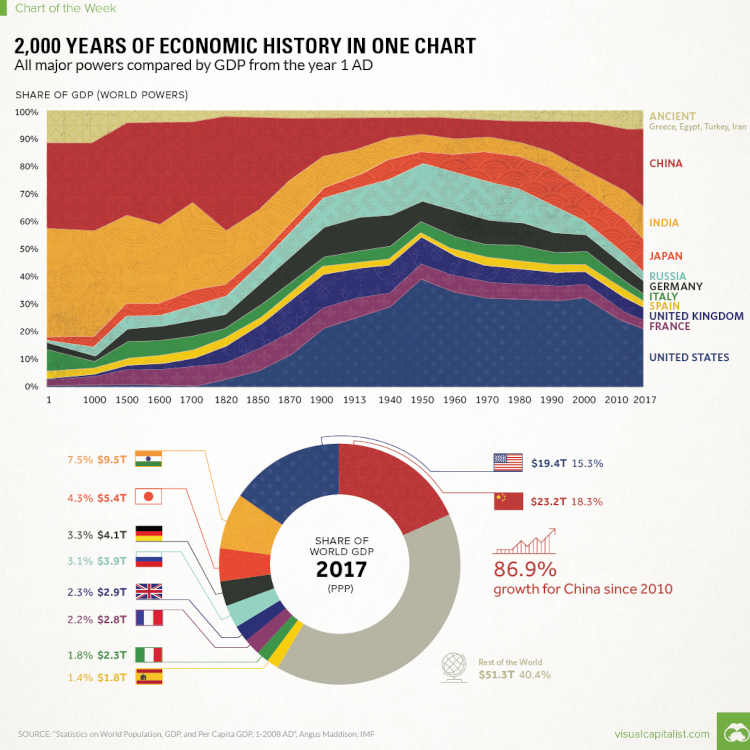

WC Hanc Tomasz: Morgan Stanley Building, Manhattan, USA In the decade immediately prior to the global financial crisis of 2007 in the UK, one million home owners have an interest only mortgage, whilst 4.5 million home occupants live in fuel poverty, meaning that at least 10% of their net income is spent on energy. As oil and gas prices rise, more homes will be plunged into fuel poverty. Energy suppliers predict that domestic fuel costs will rise by 40% this year. The UK is now a net importer of energy. There is no excuse for matters being this bad. HMG had two decades to come to a cost effective and clean solution. Why was North Sea gas burnt off so quickly in our power stations when its use should have been prolonged through domestic use only? North Sea oil and gas revenue, plus the tens of billions of pounds made from the sale of nationalised assets should have been invested for future need, globally and in a science based society in the UK. It was not. The family silver was sold off without a referendum on the subject. UK manufacturing output is now just one sixth of what it was, with HMG showing no signs of revitalising it. Factories have closed due to predictable cut throat competition from sweat shops in the Far East. The machines have been auctioned off for scrap or to businesses on the far side of the world. To rebuild that factory in the EU would be virtually impossible, since the specialized machines are not available and the machine manufacturers probably no longer exist. To build a replacement you would have to reverse engineer it, assuming you can acquire one, because it is not possible to design sophisticated machines from scratch, because the existing ones have probably gone through at least twenty design changes over many years. To put it bluntly, our politicians within government have committed treason. Over the last six decades, politicians in the UK have probably inflicted more damage to this country than terrorists ever could.

In 2009 the electorate saw the humiliation of a PM with his begging bowl at an OPEC meeting in Jeddah, pleading for 100 billion pounds of investment in clean energy. This is the unacceptable face of capitalism coupled with the impotence of government at its most striking. Why should these countries invest in a bankrupt nation that clearly has no effective government, no dependable political system and no up to date constitution? HMG has, beyond a shadow of a doubt, proved to the entire world that the human race is definitely not an intelligent species. With no obvious way for the intelligentsia to legally update our constitution, we appear doomed.

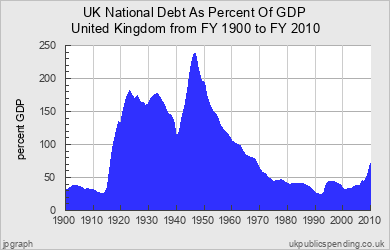

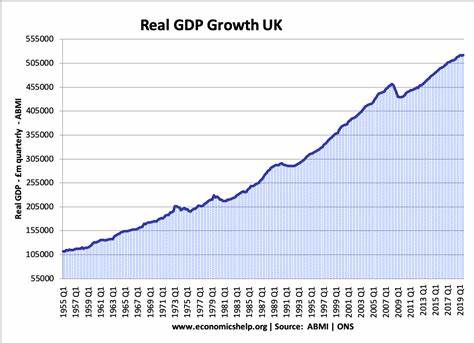

In early June 2008 the European Commission announced that it was to start proceedings against HMG for breaching economic rules. Its budget deficit is too great. Unfortunately the UK is a bankrupt nation with 1.4 trillion pounds of personal debt and HMG's national debt of around 824.8 billion pounds (October 2009). The UK personal debt is 1.576 trillion pounds+ and national debt 1.8 trillion pounds+, 83% of GDP (2019). After ten years as chancellor, and having watched the UK pull out of the ERM (European exchange Rate Mechanism) one would have thought that our PM (Prime Minister) would have realised that no government can influence the global economy. Of course the bailing out of Northern Rock Bank was all about winning over the northern electorate at the next general election. Our personal debt is greater per capita than that in the USA where the selling of US sub-prime debt triggered the global credit crunch. In the UK negative equity increases as property values fall against mortgage payments, whilst home owners ask themselves 'where is the incentive to work'. If it was not for our Benefits Agency paying the interest on mortgages of the unemployed, after the initial six months of registered unemployed, I shudder to think where we would be now. That option is not available for buy-to-let mortgages, as the Bradford & Bingley has discovered, and has now asked for 250+ million pounds from its shareholders, since the US Texas Pacific Group pulled out. There is an estimated $800 billion of sub-prime around the world plus $62 trillion of credit default swaps (CDS), all classified as risk. Unfortunately the negative equity in cars is not covered by anyone. Automobile prices are falling in the UK as there are 25% less customers for second hand cars.

In the 1980s the Conservative PM Margaret Thatcher sold off most of our nationalised assets, using the proceeds to subsidize the top rate of income tax. No one in Parliament nor the police nor intelligence agencies had the guts to stop what was an obvious misuse of the nation's assets. Their grubby hands were only too willing to see themselves paying less tax. It was a blatant bribe to the well off civil servants, politicians and millionaires. Over the coming decades the nation was asset stripped by politicians corrupted by greed, enabled by capitalism. These proceeds should have been invested for a rainy day in a sovereign wealth fund, eventually being used to build the 100 Mbps internet and 'an all electric' eco-friendly society. As it was, HMG in order to satisfy its brainless faith in capitalism decided to have the nation's internet installed by a plethora of competing companies, which meant that costs would be high and customer revenue thin on the ground. The obvious solution would have been for prospective Internet Service Providers, the investors, to form a holding company. The holding company would install the fibre optics, etc. and manage the entire operation. It would be the sole ISP limited to a profit of 5% pa as approved by OFCOM. Unfortunately politicians don't want to think along such simple lines. They want competition and chaos, which leads to high prices. Prices at the moment are:

The UK does however have a rudimentary sovereign wealth fund in the name of Crown Estate. This was created in 1760 and is a major land owner in the UK. It is autonomous to a certain extent, but is required to hand over its profits to HM Treasury. It does beggar the question, why wasn't the proceeds from the sale of our nationalised industries in the Thatcher era, handed over to Crown Estates and reinvested in the nation's future, possibly to finance the state pension and social care? It should be beyond the clutches of apathetic, incompetent and corrupt politicians. Maybe one day parliament will make it so.

BT Openreach was 480 pounds but has been reduced by about half, and includes football TV channel, phone

TalkTalk 240 pounds uses BT phone line

Virgin Media(was Telewest) 360+ pounds includes numerous TV channels, phone, etc.

Sky use BT phone line

This is in addition to a compulsory TV licence to finance the BBC at one hundred and forty five pounds and fifty pence per annum. It has all proved to be too expensive for many people including me. Currently (2016) there are talks to reduce these charges by scrapping the Line rental of 18 pounds per month, or not charging line rental when you are not connected to the internet. I'll believe it when it happens. Whether I will get a free TV licence when I'm 75 is still in abeyance.

WC Hänsel und Gretel: Merrill Lynch Building This same government scrapped the wages councils which ensured that professionals received a real wage, then undermined the power of trade unions, making it easier for companies to sack their 'overpaid' middle management. Having replaced them with younger managers paid mainly through bonuses and hence with no loyalty to the company they work for, in a hire, fire and forget environment. With such disloyal employees, you end up with irresponsible lending, as the companies traditional work methods are discarded, resulting in a credit squeeze caused by financial institutions not knowing whether fellow institutions will be able to repay loans. Banks, that cannot find an Arab sheik to bale them out, are now engaged in speculation on the commodity markets, particularly oil, in a desperate attempt to keep their heads above water. In April 2008 the IMF stated that the sub-prime could cost 472 billion pounds, the risk shared between shareholders of hedge funds and the clients of pension companies, the cause being lax regulation. As the speculation continues and the price of a barrel of crude oil goes from $88 on 12-10-7 to $130 on 16-6-8 and back to $78 in November 2009, one is left with the question, where is the stability necessary for a global economic recovery? Will there instead be a global recession and banking collapse? In early 2016 the price of a barrel of crude oil fell to $30, then twice that in August 2019.

One gets the impression that oil companies, seeing their petition by directors of British industry ignored by the PM, and now faced with legal challenges by environmental groups over global warming and inevitable financial compensation cases brought by insurance companies in the future, are trying to force action from governments. The G8 are powerless as people are killed in fuel protests and food riots following the reduction in fuel subsidies around the globe in 2008. In 2009 I could see this would lead to global recession and global banking collapse, initially created by an economic ideology called monetarism. UK governments for the last forty years have encouraged equal job opportunities for women, undermining job security and real wages for men, whilst simultaneously destroying the sanctity of marriage through liberalised divorce. As a result, too many people were now looking for work, putting pressure on inflation, as governments have presumably intended. The expansion of the EU has had a similar effect. With marriages at their lowest level since records began in 1862 and wages at rock bottom, there is little incentive for men to work, as the national minimum wage is lower than long term welfare benefit levels, whilst the cost of commuting to work rises. Food prices sky rocket worldwide due to shortages, as crops fail in Australia due to drought, land in developed countries is used to produce bio fuels instead of food, as the populations in the Far East switch to western style meals with more meat content, which requires more grain for the farm animals.

More elderly people and children in the UK are now classed as living in poverty, as a clueless government presides over a soon-to-be third world nation. Most of the UK's wealth is tied up in its property, but since that is only worth what someone else is prepared to pay, that wealth can disappear virtually overnight, leaving a nation little better than Argentina, which was one of the richest nations on Earth prior to World War II. The PM in Downing Street states that the fuel and food crisis' are a world problem, but where is the world technocracy that has the acumen to sort out the mess? Four hundred people are being investigated in the US over the sub-prime chaos, with two hedge fund managers at Bear Stearns arrested, then found not guilty in November 2009. Presumably there is a similar investigation on this side of the Atlantic Ocean, but many of them are part of the British establishment, which many believe is immune from prosecution.

A classic example is the rearing of chickens in factory farms. Whilst there are laws on the treatment of animals on farms as in homes, our largest supermarket can somehow get away with over feeding chickens to the point where not only do their legs break under the strain, but due to lack of exercise, their fatty meat is eventually little more than junk food on the shelves, far removed from what healthy chicken use to be like. There is no ambiguity in this case, in my opinion. The directors should go to prison, including the directors of major shareholders who recently voted for a continuation of this vile practice. Their greed overcomes any sense of morality. Like chickens, as each day passes, more people are enslaved in the global economy, one way or another. Like global terrorism, global pandemic and global warming, the global economy is a matter that must be put right, one way or another. Will British banks be suing US banks for compensation?

WC Johannes Geiger: Lehman Brothers Building Few of the UK's MPs have relevant qualifications and training, which in my opinion is the prime cause of this nation's decline. None of them are worth the 130,000 pound salaries they are presently receiving, not to mention their dubious expenses. Why should an MP be allowed to claim expense on a property in London which he is allowed to keep after he retires from office, for instance? Put them all up in Travelodge Hotels. They can get to know the needs of the general public better by working there as waiters and cleaners during their 91 days annual holiday, instead of jetting off to the South Pacific to watch... rising sea levels? Of course one could say that they are worse than amateurs. They are in effect members of an illegal organisation called the British establishment. One can't call it more than that, since their organisation has no written constitution, which has definitely not been approved by the electorate. That makes them imposters doesn't it?

I well remember the communist Labour government cancelling major aerospace projects conceived by the previous Conservative government, the TSR2 tactical strike and reconnaissance aircraft, the HS 681 jet transporter, P1154 supersonic VTOL fighter, Black Knight rocket / Prospero satellite, and Blue Streak booster rocket for ELDO, which eventually was superseded by the French Ariane rocket and ESA. To date, the UK has not recovered its lead in aerospace. Party politics has contributed greatly to the destruction of this country's economy, which is why I favour the outlawing of political parties in favour of independent technocrats. Unfortunately there are few of these around at present. Young people are not interested in going into politics, resigning themselves to a 10,000 pound to 30,000 pound overdraft when they graduate from university. University fees are the penalty for not voting. Their parents show little enthusiasm either, knowing full well that most of the electorate will only vote for political parties, whilst the media only want to rake up their embarrassing past. And of course, standing on that stage in full view, as the votes are read out, is one humiliation too many. Best to retire abroad, far from the maddening crowd. At the next general election the electorate will be out there, many voting Conservative, not realizing that it was Ronald Reagan and Margaret Thatcher's monetarism that are the prime cause of the world's present economic woes. Don't vote for political parties that have ruined your career and wrecked your marriage. That's what I say. Where possible, vote for an independent technocrat.

WC: Fannie Mae Headquarters In the past ten years 2.3 million people have drifted to the south-east in search of employment, whilst another two million have left the country completely, totally disillusioned with a political system which is anything but democratic. There was no referendum on joining the global economy, nor on scrapping the wages councils, aerospace projects, abandoning our television and home entertainments industry, jobs for women and signing the EU Lisbon Treaty. As bills mount up, people have their personal problems to worry about, burying their heads in a world of TV soap operas as a form of escapism.

Since HMG is prepared to compensate bank and building society depositors in the event of a crash, that makes politicians responsible for ensuring that these financial institutions do not crash in the first place. And yet it would appear that neither HMG nor the central bank, Bank of England, have the vaguest idea of what is going on in these businesses. In my opinion it also makes individual politicians legally liable for what has taken place. Since then a bank stress test is carried out regularly by the European Central Bank. There is an estimated one trillion dollars of sub-prime and abandoned properties in the US. In Cleveland entire neighbourhoods are deserted. With continuing low wages and contract related employment around the world, the situation will only get worse. In the event of a bank collapsing, HMG will compensate 100% for the first 85,000 pounds, through the Financial Services Compensation Scheme (2019). Even so, assuming individuals are compensated, will retail outlets recognise the original value of the currency, when their businesses have suffered substantial losses? There will be a great temptation to increase prices. Like the economic turmoil in Zimbabwe and pre war Germany, will a loaf of bread cost 50,000 pounds?

WC C R: Bear Stearns Building On November 11th, 2009 the governor of the Bank of England, Mervyn King, announced that bank lending will remain weak over the next three years. From where then will the necessary finance come from to create the necessary export growth potential necessary to pay off the nation's national debt? In reality growth remained weak for the next ten years and is still only chugging along.

These are the heart beats of a dying nation. From Global Britannia, to Great Britain, to Gone Bust in less than half a century.

The global economic crisis began officially on 13-08-07, soon after the French bank BNP Paribas announced that triple A mortgages bought from banks in New York, USA in fact contained sub-prime mortgages making it unlikely that the home owners would pay off this debt. This meant that the package was worth a lot less than it first appeared. This scheme affected millions of mortgages, and hundreds of billions of dollars. It destroyed trust between banks, bringing to an end the concept of short term (hours) loans between financial institutions.

At that time one in four Britons had no savings, the UK personal debt was 1.345 trillion pounds amongst 8.2 million people, 125,000 mortgages were in arrears with 14,000 homes repossessed during the first six months of 2007. Personal bankruptcies numbered 26,956 from May to June 2007. This is the result of thirty years of monetarism (Reaganomics in USA), no wages councils, no strong trade union movement, virtually no HMG regulation of businesses and no strategic large scale investment plan. As a result, the same worn out economic handle (spend spend spend) is being turned, to stimulate the global economy (you buy from us and we'll buy from you), whilst the US Congress and President Obama's administration has already decided that the loss of millions of US jobs to sweat shops in the Far East is a step too far. Although American workers had to wait for President Trump to come along before anything substantial was done about it. Thus far HMG has stated that its stimulus package consists of insulating homes, fitting PVA (photo-voltaic array) to roofs and building more wind turbines.

Due to the sale of $3 trillion sub-prime by New York based corporate investment bank, Lehman Brothers, $2 trillion of which was sold to financial institutions outside the USA, this massive fraud created gross distrust between banks, resulting in the collapse of the interbank system, upon which almost all banks had become dependant. Banks refused to lend to banks and there own customers due to a lack of credit. Desperate for liquidity companies sold off assets, both property and company shares. There were more sellers than buyers, as a result of which property and share prices fell. This downward trend continued because the trend is self sustaining. Customers removed their money from bank accounts and deposited their wealth in more secure National Savings, Gold and government bonds. To counter this trend, the Bank of England has now provided 75 billion pounds to possibly 150 billion pounds of quantitative easing, government bonds lent to UK companies, via our apparently bankrupt major banks, to be used to stimulate the economy. That beggars the question, what in our shrunken and largely government abandoned economy is there left to stimulate?

WC: Freddie Mac Building And gone bust may soon happen to all of us, with rising gas prices going through the roof due to gas pipeline restrictions from Russia in October 2021. There was a time when the UK was energy self sufficient. Then all that stability was thrown out of the window when the Thatcher government in the 1980's privatised the nationalized industries including the British Gas Corporation. And needless to say it wasn't long after that they were all pursuing a policy of free for all capitalism, with loyalty to the global economy taking precedent over loyalty to the nation. Diversification, stock related bonuses, golden handshakes, lucrative pensions. Even British Gas was selling off its gas mains to pipe installers, making its gas too expensive for many even in a normal year. Since Elon Musk bought the raw materials for his stainless steel rockets direct, why couldn't HMG buy gas direct? There appears to be no way out of this problem other than bankruptcy.

HMG is already four trillion pounds in debt. What does it take to finish off the world's financial system? There were at this moment 83 container ships at anchor off Los Angeles and Long Beach docks in the USA. The natural gas price had gone up from 55p/therm on May 19th, 2021 to settle at about 234p/therm on October 15th. Due to the need for batteries for EVs the price of copper had gone up to $1000 per tonne, whilst the cost of producing aluminium in electrolytic furnaces had caused its price to rise to $3000 per tonne. Are individuals, companies or a certain government manipulating the commodity markets? To cap it all, Unilever then announced that the price of my favourite marmite was likely to increase considerably, owing to increased transportation and processing costs. Clearly a world order was needed to manage the world economy. As of October 22nd, 2021 there is still no call for the reactivation of Civil Defence, to drive lorries, gather harvest, process and distribute food, nor build swarms of sea current generators or the Severn Barrage, nor to give school leavers and the unemployed one years work experience in emergency services, care homes, farm labouring, production line operations, etc. We have the same pathetic political system that led us into WWII. It appears that nothing is going to change this side of WWIII or a bloody revolution. It's pathetic. The way things are going, it won't be long before we have to take a page out of Ukrainian history and dig our own graves.

In January 2022 the charity Oxfam revealed that the wealth of the ten richest men had doubled during the pandemic, since March 2020. Just days later 100 of some of the world's richest people, known as the Patriotic Millionaires,' issued an open letter to the world asking their government's to increase their taxation. This is all prior to the World Economic Forum at Davos, Switzerland. The taxes were slashed by Reagan and Thatcher decades ago, plunging governments into debt. Will the world's economists support such a move, or will the corruption in high places continue? Of course things don't have to be that extreme. Governments could take entrepreneurs, with good ideas, under their wing and provide them with technical, recruitment and legal support, whilst finding a billionaire or millionaire to provide them with the necessary financial backing, whilst the government would take on the risk. Unfortunately we have governments that are incapable or simply unwilling to do anything.

You may think that things could not get any worse. How wrong you are. Let's talk about pyramids, not pyramid selling. Between now and the year 2035 the human race will see the greatest changes ever. AI will put all of us out of work, if the world's thumb sucking government's have their way. And all they will do is nothing as usual. With all of us out of work, how will the welfare state be financed? If your country's got one, then it won't be. This is because the necessary tax revenue will be insufficient. AI will not only destroy jobs, it will indirectly destroy consumerism, and not simply due to lack of purchasing power. With so few workers needed, there are fewer commuters. The workers can't afford to buy a car, so they hire zero polluting, computer driven taxis. One manufacturer has already decided that theirs can be converted into delivery vehicles, also. As a result, automotive manufacture plummets 75%. As does tax revenue from them. The welfare state comes to an end. Consumerism comes to an end. What happens to civilisation when the developed world reaches that point?

WC: Inflation in UK since 1900 OIP We only have to look at the Arab spring. How many governments want to go down the same route as Syria? Now not too long ago, governments, fearful of the mob rioting, would create grandiose construction schemes, designed to keep the masses placated. Castles, cathedrals, great walls, mausoleums, ziggurats, and of course the pyramids of the Americas, middle east, Nigeria and Indonesia. So just how are the governments of the modern world going to placate the mob. Well one thing's certain. They won't do it without being kicked up the arse first. The decision will have to be by international agreement. They can't even create an international tax rate system. With all the mounting piles of national debt, you just know that pretty soon, all currencies will become worthless. So we've got deadbeat government's, and currencies definitely in the crypt. Capitalism has destroyed capitalism. It's plainly obvious that the human race needs a professional system of world government, a world technocracy, and an incorruptible means of reward for compliance, the Specific Person Electronic Voucher. And anything less than equality is definitely out. It's time that all you retired professionals became independent technocrats. Most of the world's ills are caused by bad government, and it's time that was brought to an end. AI, bio engineering, overpopulation, global warming, demonstrations, civil wars. Time in which to act is rapidly running out.

That Friday September 23rd, 2022...Just weeks after the resignation of Prime Minister Boris Johnson, due to partygate and numerous other fiascoes. HMG's Chancellor Kwasi Kwarteng read out his mini budget statement in the House of Commons. It did not go down well. The budget cancelled the previous chancellors anticipated tax increases and even cancelled the top rate of income tax. It was clearly not a budget for growth from government. HMG expected our millionaires and billionaires and financial institutions to finance growth, but most of these businesses and investors were still recovering from the Covid-19 lockdown, and now global inflation, which was increasing raw material costs, much of it priced in US dollars. There was also a shortage of labour due to the pandemic and Brexit. Over the weekend, there were thousands of troubled minds, all over the world, wondering what to do. That day 1150 illegal immigrants crossed the English Channel in 21 boats to the promised land.

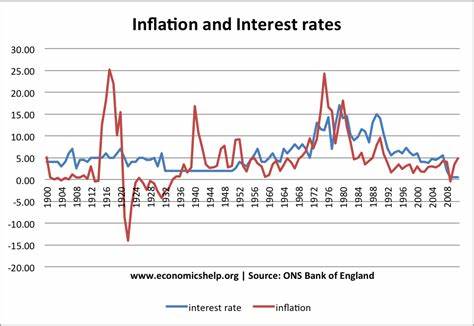

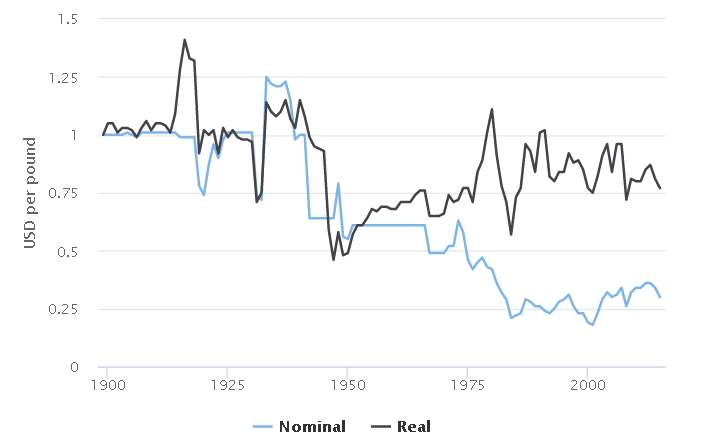

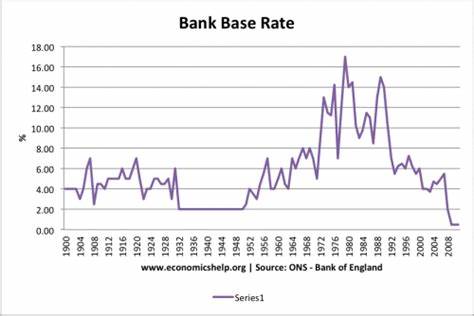

WC: Gross Domestic Product in UK OIP Monday, September 26th, 2022...My life was in a mess, but that was nothing to what was unfolding. The pound fell against all currencies. Soon the pound would be worth just one miserable US dollar, when in 1900 it was worth five. Gilt prices doubled and building societies cancelled 935 home purchase schemes, having sensed that interest rates were going to rise substantially. Within 4 days 1621 mortgage products were withdrawn. As gilt rates rose from 2.5% to 5.0%, the Bank of England was obliged to carry out an emergency intervention, by buying up £65 billion of gilts in order to protect pension funds. Conservative MP's called the budget statement inept, naive and arrogant. Interest rates rose immediately from 3.5% to 6.5%, but eventually to 10.5% as the base rate increased. With thousands of mortgage holders expecting the interest rate freeze to last years, such a prospect would be calamitous. It was see-saw economics with the Bank of England increasing the cost of living, whilst HMG reduced it. The last governor of the Bank of England, Mark Carney, complained that HMG had made things worse by not publishing the economic forecast by the Office of Budget Responsibility (OBR) at the same time. Despite efforts by the Bank, the underlying problems still persisted, as HMG refused to change tack. At a stoke, the Conservative Party had proven beyond a shadow of a doubt the need for a technocracy. I simply failed to understand why competent Conservative MPs had not stood for party leadership, and also why hadn't this budget statement been perused over by the party grandees, before its release? The main opposition party, Labour, wanted a recall of parliament and a fresh budget. At the Labour conference in Liverpool, all they were offering was an investment of £8 billion in battery and green steel production, when in my opinion HMG needed to invest £100 billion in green energy projects for the home front and Europe, and food production under glass to reduce our dependency on imports. I was also of the opinion that it would take a 60 hour week and the cancellation of the welfare state in order to pay off the nation's debts.

September 30th, 2022 was the final date that £20 and £50 paper bank notes were legal tender in the UK. They were replaced by plastic bank notes. The paper bank note withdrawal began in late February 2022. Just how much was not handed in remained undisclosed. How much was still in the black economy, too difficult to reintroduce into the legal economy? On November 28th, 2022 it was announced that a drug cartel had been exposed amounting to 49 arrests in 6 European countries by Europol. 30 tonnes of drugs had been seized. The cartel was believed to have supplied a third of all cocaine to Europe.

WC: Bank of England, London, UK In November 2022 I went to the Bank of England's website to see why raising interest rates is necessary. Fortunately for me there was a 'letter box' into which I could tell them what I thought of this policy. The letter went roughly as follows:

WC: Parts of the World's Share of Gross Domestic Product Friday, October 14th, 2022...After the governor of the Bank of England, Andrew Bailey, stated that bank support for guilts would end that day, and after Prime Minister Lizz sacked her Chancellor Kwasi Kwarteng, markets remained jittery. The new Chancellor Jeremy Hunt would not make the official medium term economic statement until October 31st. There would be no cuts in income tax and corporation tax, but that was about all anyone knew. Just how would go for growth be financed and what growth would there be?

So just how would my speech be presented in the House of Commons, designed to rattle the bones of the British Establishment?

Thank-you mister speaker for this honour.

For at least the last fifty years I have witnessed this nation's decline due to one hapless government after another making irresponsible decisions with no regard for the long term consequences. The empire was trashed simply to get trading concessions from the United States. Guaranteed markets for our products and services were largely abandoned, whilst our sterling pound currency was opened up to speculators. With many commodities now valued in US dollars the repercussion of these decisions was obvious. The pound declined in value, but also protests for independence gave way to brutal suppression from dictators in many of those now Commonwealth nations. With it the esteem associated with HMG evaporated, as the UK became a minor member of the European Union. Eventually the government sold off the nationalised assets and used the revenue to finance an unrealistically low top rate of income tax. Those nationalised industries belonged to the nation, not one small part of it. The revenue should have gone into a sovereign wealth fund, to be invested at home and abroad, in order to finance the state pension on the day we are all pensioned off by the march of Artificial Intelligence. As it is, the British Government has no plan for such an eventuality.

Today we have a government incapable of coming up with an acceptable budget plan. Small mindedness, negative thinking and party politics have doomed this nation. I see no positive mindedness, no risk taking, no vision and grandiose ideas. Look what happened to Black Arrow rocket and its satellite Prospero. Within one decade of its cancellation we could have had a space industry mass producing Earth resources, television direct broadcast, weather and navigation satellites, with internet satellites to follow. By now the BBC could have been broadcasting worldwide, supported by compulsory revenue from British organisations advertising their products and services to the world, whilst also providing educational programmes and subsidised IT applications and satellite data.

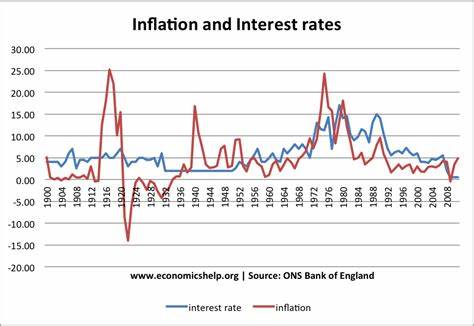

WC: Inflation & Interest Rates in UK Looking across this house I see only a deadbeat organisation devoid of vision, management skills and the determination to create a better world for all. For fifty years the holidays have been going on for too long, mister speaker. The empire economy has been replaced by a cut throat global economy. If this nation is to survive then it must work by the same rules as its competitors. To achieve this it is necessary to set up a command economy. For the government to control their activities, it will be necessary to restrict their number and impose standards as follows:

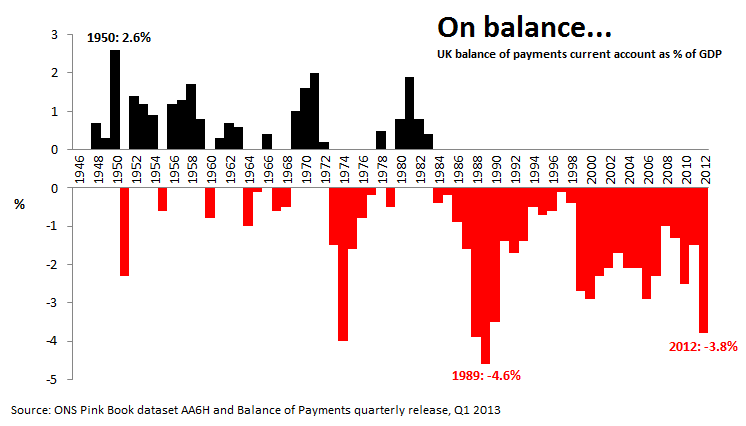

WC: Trade Gap in UK There was a time when the monthly trade gap figures were displayed on TV news, but HMG came along and said that it no longer mattered. Well of course it matters, because the value of our currency is determined by how much it is in demand by foreign companies that want our exports. When we export a product or service to another country, the recipient in that other country has to pay in GBP (Great Britain Pounds Sterling). The more in demand our currency is, then the higher its value, and hence the more expensive our exports are, and vise versa. Employment figures, inflation rate, base rate of interest and GDP (Gross Domestic Product, the value of all goods and services a nation produces, usually in one year) are the economic indicators that determine a nation's economic health. House prices are another. For years HMG has been trying to build more homes, but more homes in the UK could prove to be a disaster for millions of families. Advancing technology drives economies, the UK construction industry included. Advances in the 3D printing of homes could see houses and bungalows being priced at £10,000, plus land price. Many families use the value of their home to pay off debts, spend on goods and services, supplement their pension, pay for their child's higher education, etc. So the long term reduction in a home's value can have serious repercussions elsewhere in the economy. Unlike cryptocurrencies, the value of real currencies is determined by a series a complex factors that are not always obvious and predictable, not greed. If an economy is to be managed effectively, then it should be simplified, from a taxation point of view, and managed by AI. AI is likely to secure jobs in the railways, health service, police, prison service, defence, farming, shipping, aircrew and production lines in the near future. Land prices could collapse with the introduction of advanced hydroponics and vertical farming, whilst house prices could go the same way if governments continue to downplay the need for families, with people sleeping in cubicles instead. Individual car ownership and existing public transport, could cease with the introduction of AI driven taxi vans and air taxis. The personal computer, tablets, laptops and mobile phones will inevitably give way to brain implants or brain enhancements. Economics is fluid. Governments must be ready for these eventualities by providing alternative employment, mainly in the field of scientific research. Above all we must learn to live with everyone in peace, and with environmental confines.

I formally submit these ideas for a command economy to parliament, with the express purpose of putting an end to a catalogue of failures committed by numerous governments, and hopefully restoring this nation's greatness.

For 20 years up until 2008 HMG told companies to relocate to the far east and eastern Europe. This ideology known as monetarism destroyed the careers and aspirations of millions of people. It created countrywide vice and slavery in the rag trade, for instance. It is now time to invest in a science based economy. Ideas and research lead to technology and competitiveness within the global economy, generating profits which then help to pay off debts.

WC: Value of US Dollar per UK pound since 1900 Managing an economy involves more than just dealing with economic aspects. As stated elsewhere in this website, there needs to be a technocracy, and a communications database (intranet) in the public domain, so that people can get in touch with experts and companies, to assist their businesses, etc. How else do we get the economy moving? There is too much privacy and not enough publicity.

Some parts of this announcement will require a referendum. If however, this economic plan fails to reduce the national debt substantially within five years, then the UK will have no choice but to pull out of the global economy, create a technocracy and abandon money in favour of SPEVs, since it would be cruel to subject the younger generation's to years of austerity, due to excesses created by their elders.With the exception of the bank holiday in celebration of the coronation of King Charles III, the holidays are over.

In 2020 the NAO (National Audit Office) announced that the Bank of England had effectively lost track of 50 billion pounds of UK bank notes, three quarters of our cash. Where is it? Who has it? Why have they not banked it? Is it illegally acquired? Is it part of an extensive black economy in the UK? Is it under the mattress, owned by people fearful of Brexit and the pandemic, and a cryptocurrency meltdown creating a global banking collapse? It clearly hasn't happened over night. Abducted by aliens? Shredded accidentally? Lost in the post? In the illicit vault of mum and dad? A computer hacker has corrupted the figures? The people of other countries have decided that it's better than their own currency or bitcoin, possibly promoted by drug barons? A few weeks after this news appeared German and Belgium police seized a total of 23.2 tonnes of cocaine found in shipping containers in Hamburg and Antwerp worth 600 million euros ($984 million). A day later it emerged that police had seized 1.5 tonnes of heroine at Rotterdam worth 45 million euros. Well that's reduced the fifty billion a bit but only a small bit. The fact that these amounts are so huge clearly shows that an awful amount of illicit drugs are getting through, and undermining our civilisation.

WC: Central Bank Base Rate UK OIP On November 20th, 2022 it was announced that the cryptocurrency exchange FTX, which had declared bankruptcy a few days before, due to theft, had debts of $3.1 billion spread amongst 50 of its largest creditors, 10 of whom were owed $1.45 billion.

On November 28th, 2022 the cryptocurrency company BlockFi filed for bankruptcy with $275 million owed to its depositors.

Two weeks later on December 12th, 2022, an international arrest warrant was issued for cryptocurrency boss Do Kwon, former head of TerraVSD and Luna Tokens which collapsed in May, believed to be in Serbia.

On the same date the US Securities Exchange Commission arrested Sam Bankman-Fried, head of FTX, in the Bahamas, for defrauding investors. In March 2024 he was sentenced to 25 years in prison.

On January 20th, 2023 cryptocurrency firm Genesis went bankrupt, due to the collapse of FTX and being charged with the sale of cryptocurrency by the US SEC (Securities & Exchange Commission).

In March 2023 Do Kwon was arrested for fraud in Montenegro, related to the collapse of TerraVSD and Luna Tokens, which were owned by Terraform Labs. The incident was described by the media as a multi-billion dollar crypto-currency fraud.

August 2023 saw the arrest of Heather Morgan and her partner Ilya Lichtenstein in New York for the theft and subsequent money laundering of $4.5 billion (£3.5 billion) of bitcoin, which they stole in 2016. Despite numerous attempts to convert bitcoin to real currency, their electronic trail led law enforcement agencies to them.

In September 2023 Sebastian Karl Greenwood, co-founder of OneCoin crypto currency business, got 20 years in prison for fraud and money laundering. His partner crypto queen Ruja Ignatova, was on the FBI's most wanted list, over the $4 billion scam.

In November 2023 the largest crypto exchange, Binance, was obliged to pay fees and a fine of $4.3 billion for money laundering. Six months later its boss Changpeng Zhao was sentenced to four months imprisonment.

In January 2024 it was revealed that Steven Reece Lewis CEO of HyperVerse crypto fund, didn't actually exist.

Was this the beginning of the end for international pyramid selling? The global financial crisis appeared to have no intention of dissipating.

December 2022...The Bank of England raised base rate to 3%. Raising interest rates in the UK is an indicator that HMG does not want growth. Growth requires government investment which leads to higher taxation. Increasing interest rates increases interest payments to investment portfolios but also takes away the recent wage increases that the masses have received. HMG was now confronted with wage demands and associated strikes by rail workers, ambulance drivers and nurses. What was clearly needed was the restoration of the wages' councils that were scrapped by PM Margaret Thatcher decades before. Was HMG up to it, or would our new PM Rishi Sunak regard the British worker with the same contempt the British Raj had towards Indian coolies. He was planning anti-demonstration legislation on UK roads and considering banning emergency service personnel from striking, whilst refusing to introduce non-dom legislation against his millionaire wife. Thatcherism was raising its ugly head again. Who would blink first? We go for growth in a command economy, or we go to hell. HMG borrowing in December rose to £27.4 billion, whilst interest on loans amounted to £17.3 billion, doubling in one year.

January 2023...In recent months major IT companies have announced redundancies caused by the continuing pandemic, increased cost of living and increased efficiency:

BT redundancies are by 2030 out of 130,000, announced in May 2023

It amounts to 200,000 jobs lost directly in the last 12 months, whilst some companies don't even list the number of contractors terminated. HMG offered £600 million to British Steel and TATA if they would produce green steel from electric induction furnaces powered by renewable energy. Meanwhile the battery gigafactory proposed by British Volt is no more, due to bankruptcy. HMG's policy was clearly to do nothing about the economy.

WC: National Debt in UK March 2023 saw the collapse of at least three US regional banks including Silicon Valley Bank and First Republic Bank. Raising the base rate of interest to around 5% at this time appeared to be an act of panic to many. In Switzerland Credit Suisse was bought out by USB for a pittance, whilst in the UK, statistics were hard to come by. Governments appeared to be doing nothing to forcibly maintain confidence, which only resulted in the panic amongst depositors spreading. By July 2023 the Bank of England's base rate had reached 5%, whilst HMG had conflicting requirements. Namely control inflation by stifling investment and job recruitment through crippling interest rates, verses growing the economy. That month the bank announced that £9 billion of old paper £20 and £50 notes had still not been exchanged for new plastic notes. They had not been legal tender since October 2022. Surprisingly, £87 million of old one pound coins had also not been handed in. They had been replaced by the twin metal design, which is far more difficult to forge. They can't all have been abducted by aliens surely.

Just how do you stimulate growth in a nation of 68 million people and 1.1 million job vacancies (325,000 more than before pandemic), when there are:

9.0 million carers are economically inactive

2.7 million students studying under the age of 25 years

3.5 million over 50s out of work due to illness

2.0 million people suffering from long covid

Net migration for 2022/23 is 606,000, mainly from Ukraine & Hong Kong

In addition there are millions of early retirees who simply don't want to work. They are sick of the lack of training, lack of competent management, poor working environment, stress, the low wage service based economy that has replaced engineering and manufacturing, and one parliament and government after another that couldn't give a damn. With the cost of living going through the roof:

Food inflation up 19%

Mortgage rate hits 6%

UK rents up 10%, amounting to 28% of gross earnings

Overall prices up 8.7%

Rentals are going up due to higher demand, as the number of properties for rent diminish due to landlords retiring, plus the huge demand from migrants. HMG costs are rising due to the increasing cost of state pensions, benefits, energy subsidies and handling of illegal immigrants. By August 2023 there were over 50,000 illegal migrants in UK hotels, with HMG planning to put them on floating hotels or remote islands. Just about the only people who want to live on a remote island are the citizens of the Chagos Archipelago, whom HMG evicted. A crazy world isn't it? Just as you thought things couldn't get any worse we have the RAAC scandal (Reinforced Autoclaved Aerated Concrete roofs in schools and other public buildings). In 1994 it was realised that these roofs had a design life of only 30 years. They had been installed from 1950 to 1990. Following a school roof collapse in 2018, the government had reduced expenditure on the problem, when it had been asked to increase it. The PM Rishi Sunak was deeply involved in that decision at the time. No sooner was the dust flying in that scandal than Birmingham City Council declared itself bankrupt over a debt of £760 million, over equal pay bonuses. Other councils were also in debt following cut backs from central government which refused to increase the super tax level. It's impossible for me to see just how the country will get out of this mess. So much talent has been discarded, so many opportunities rejected over the decades by HMG. Government contracts are costing tens of millions over estimates, because they now have to comply with environmental restrictions. And for the individual, there is ULEZ, a payment of £12-50 for each day that a non-compliant car is used in the greater London area. Created by London's Labour mayor, no doubt all cities will get their drumming down soon. Mayor Sadiq Khan is of course right. There are rumours that HMG is about to introduce prison sentences for those that do not comply with environmental laws. Expensive beaucracy reigns. The leader of the opposition and Labour Party had already stated that the next Labour government would not increase taxes. One looks into the history books for an answer, then look up and say, "the dark ages". It's clear to me that only a technocracy is going to use advancing technology to improve the economy and people's quality of life.

In August 2023 the Swiss bank UBS was fined 1.4 billion dollars for its part in the 3 trillion dollar sub-prime mortgage scandal, which triggered the global financial crisis from New York in 2006 to the global banking system. A few weeks later UBS announced profits of $29.3 billion, mainly from the takeover of their competitor Credit Suisse. At roughly the same time it announced 3,000 redundancies. As if that wasn't bad enough, many of the banks illustrated here are now selling off their property portfolio. Not because they have run out of money, but because of their employees working from home during the Covid-19 pandemic, which has been such a great success, that many office blocks are no longer needed. The situation in the PRC is even worse, where new cities stand almost empty, because the peasants prefer their equivalent of the UK's back to back housing, rather than live in cramped and impersonal tower blocks. As a result, property developers are billions in debt, with many individual investors and banks worried about the global consequences. Cryptocurrency indices are falling as the search continues for a safer way to invest. The safer way of course, is with artificial intelligence based investment apps. You don't need to understand high finance. Just cough up a minimum amount, say £250, and watch it grow. It's now clear to me that the cryptocurrency fad has had its day. This is the age of AI, good or bad, rich or poor. Till death through excess, do us part.

The global economy doesn't stand still. It's shaped by technological advances, good ideas in management, and unforeseen bad events. One of the latter is the potential collapse of the property sector in the PRC. In September 2023 Bing AI Chat had this to say on the subject:

The collapse of Country Garden and Evergrande could have a significant impact on the global economy. Country Garden Holdings, once the gold standard in China’s property industry, has cost stock and bond investors steep losses. Now, the developer stands to potentially inflict wider damage on the economy than the high-profile default of China Evergrande Group. The economic and political situation in China is even more desperate than it looks (and it looks really bad), but could the US go into meltdown too? It could easily happen. However, according to Capital Economics, on its own, a managed default or even messy collapse of Evergrande would have little global impact beyond some market turbulence. Even if it were the first of many property developers to go bust in China, it would take a policy misstep for this to cause a sharp slowdown in its economy.

Ideas 36...Global Financial Crisis From The Soapbox

| Raising the base rate of interest to 3% on November 3rd , 2022, the largest rate hike since 1989, and then stating that the UK is faced with a two year recession, is a self fulfilling prophecy, which will earn the Bank the title of 'grim reaper of Threadneedle Street. It will increase mortgage rates and hence rents, and increases borrowing costs for individuals, companies and HMG. It deters HMG from investing in major capital projects, and makes paying off the national debt more costly. The present inflation is from global pressures that the Bank of England has no influence over. Raising interest rates has more associated disadvantages than advantages. |

|---|

| Most citizens in the UK are no longer wealthy thanks to a lack of job security, abolition of wage's councils, the undermining of trade union power, the failure of HMG to provide a steady supply of major capital projects whilst telling companies to relocate abroad, plus too much automation that has destroyed the aspirations' of professionals. HMG has done nothing to improve working conditions and training for decades. It is the perfect recipe for economic disaster. Twiddling with interest rates is miniscule compared to what really needs to be done. |

| There are 52 reasons listed on my website, www.world-technocracy-now.earth as to why people can't get a good job. It is plainly obvious to me that we need a technocracy, specially at a time when we are at war. Not higher interest rates, which are a left over from our trade union bashing days. The Bank of England should concentrate more on raising hell with HMG, regarding the size of our black economy, which can only be defeated through a totally electronic money system, plus a command economy where all organisations have to be approved, with their financial systems monitored by HMRC's advanced IT systems (AI & quantum computing) in real time. It is clear to me that with conflicting interest rates, Bank of England v HMG investment, HMG control of the Bank of England should be restored. UK inflation in October 2022 now stood at 11.1%, the greatest rise in 40 years, as wage increases fell short by 2.7%. With companies either going to the wall or announcing massive redundancies, the 8 billion people in the global economy were facing recession and stagnation mainly due to a lack of competence in government and banking. Populations explode as job vacancies implode. The human race had increased by one billion in just 11 years. Most of the jobs available for them will either be insignificant, duplicated or illegal. This creates the greatest pressure on inflation, far greater than any bank rate, as billions of people spend a large proportion of their time looking for work. How long would it be, and how much misery would the masses have to endure, before they get a world technocracy. |

| wtn.earth Saving the human race from itself. |

Command Economy Clauses |

|

|---|---|

| 1 | The command economy will be diversified. The success of an economy is dictated by its sales. It may therefore be necessary to offer countries a complete package of both goods and services. |

| 2 | The command economy will be financed through taxation and not borrowing. The top rate of income tax will be set at 90%. With the exception of existing millionaires and billionaires, people will not be permitted to have wealth greater than one million pounds. People will have to give their wealth away to other persons or to AI HMRC & HM Treasury. The government will encourage an egalitarian nation where possible. Plastic currency will be replaced by digital, managed from top to bottom by the AI, HMRC & HM Treasury. Outstanding paper currency will be declared worthless. The black economy must be defeated. This is no different from what has happened in Russia and India. HMG has to get a grip on the economy and this is the only way. Tough love. |

| 3 | As long as the national debt and corporate debts exist, all workers will be paid the national minimum wage only. There will be no exceptions. |

| 4 | As long as the national debt and corporate debts exist, all workers will work 60 hours per week, six days per week, in line with our competitors. Employers will decide what the ratio of work to other activities is to be. |

| 5 |

There will be no more than 10,000 approved organisations.

These organisations will employ people directly only, including

security, canteen & cleaning staff. There will be no gig economy.

Approved organisations will provide job training, a clean, modern

and quiet working environment. Canteen, gymnasium and social club

will be provided. The working week will include live entertainment

at lunch times, plus fitness routine. Employees and their families

will only use the medical facilities provided by their employer.

These approved organisations will manage and pay for the National Health Service. |

| 6 | The Ministry for Technology will decide how inventions are handled. Whether they go to an existing approved organisation, or a new one is created. All organisations will be inspected regularly, and provided with legal, financial and technical support. New AOs will be cooperatives where possible. |

| 7 | Each industry will have its own training and research centre, created out of existing higher education establishments, which will no longer function. Existing buildings and equipment will be government owned with AOs paying for their use. |

| 8 |

It is the government's intention to invest heavily in green energy projects,

in order to satisfy the demand for energy from the continent. This should contribute

noticeably towards paying off the national debt. Energy projects will be based upon

photo-voltaics, tidal barrage, mini hydro, wave energy, sea current and nuclear fusion.

Whilst the UK supports several nuclear fusion projects such as JET, MAST and

Tokamak Energy, the potential of HB11 Energy, based in Australia, cannot be ignored.

This is likely the smallest and hence easiest reactor to mass produce and power housing

estates, ships and aircraft. Factories will be provided in anticipation of such mass

production, whilst electricity substations will be upgraded to accommodate them. |

| 9 | Everyone will work within their physical and mental capability.

It is estimated that one in ten people require someone else to look after them.

Whilst many of these people can be employed in menial tasks, there are many who cannot.

This is not only a burden on the taxpayer but also a mental strain on the carer.

As such, a bill will be brought before parliament to enable the euthanasia and

assisted suicide of such people. |

| 10 | With many people having not seen a GP in years, it is plainly obvious that the NHS requires a drastic overhaul in how it is structured and managed. This government has no intentions of privatising the National Health Service. However, as with all services provided by this government, control needs to be centred and carried out by computer algorithms. GPs will be made redundant through the use of the NHS AI GP, which will be in English only, as will all other government services. GPs will be reallocated to hospitals, to be employed in accident & emergency, hospital wards and medical research laboratories. Nurses will be employed visiting homes and work places to collect urine & blood samples, and carry out vaccinations. Where necessary auxiliary doctors and nurses will be called up from the retired list or trained from amongst school leavers. |

| 11 | There will be no welfare benefit system, since everyone will be in employment. There will also be no state retirement pension. Having given one third of adult males a criminal record, barring them from retiring abroad, and having given independence to parts of the world that could have provided that place in the sun for them, retirement has become a great let down to most people, many of whom would prefer to work on, were they allowed to work a shorter working week in a far more pleasant working environment. It is the intension of this government to make that vision a reality. Existing pensioners living abroad who have no private pension plan, will have to decide whether to return to the UK or seek alternative means of support. This nation is bankrupt. It is therefore necessary to tighten our belts in every way possible. Retirement abroad outside the pound sterling zone has undermined the value of the pound. HMG has had years to address this problem but has done nothing. |

| 12 | In order to protect the pound sterling further, it is now illegal to deposit British currency abroad, except by approved organisations that need to spend it abroad. |

| 13 |

Bureaucracy within government and its associated costs will be reduced through

computerization wherever possible. This will result in the closure of regional, county

and borough councils, and their replacement with an all embracing complaints department (CD).

The complaints department will have the power to stop wages to individuals and support

to approved organisations that do not comply with the CDs demands. |

| 14 | We now have to admit that capitalism has had its day. It has served humankind since the days of the Knights Templar, Islamic renaissance and the Crusades. It is now time for developed nations to move on. This does not mean that nations should simply ignore their debts. Without an international agreement on the subject, nations must pay off their debts before moving on, otherwise a collapse in capitalism would create a politically destabilizing situation amongst the developing world which is likely to contaminate future progress worldwide. Naturally with people working such long hours, it is only right that they should expect a substantial reward. Many people see themselves retiring in warmer climates. However these climates now appear to be too hot. With the introduction of cheaper electricity via nuclear fusion, it is possible to transform our way of life, in particular our housing. No one should disagree that our aging housing stock should be replaced, but with what? Bungalows with indoor swimming pools, sauna, gym, walk in wardrobes and en suite shower rooms, should be 3D printed to satisfy 21st century aspirations, incorporating biomes supporting hydroponics, in order to reduce carbon emissions. These communities would be self supporting, possibly incorporating cottage industries, with larger biomes for the production of grains, etc. Meat would be produced by artificial means. This high quality and expensive housing scheme would be for family units, and not single parent families bringing up delinquents. |

| 15 |

In order to improve the nation's balance of payments and improve the nation's mental

well being, holidays are banned. Instead the approved organisation you work for will provide

educational breaks for the family, within the UK. These will visit stately homes,

museums, theatres, etc., designed to broaden the mind and reduce our carbon footprint,

that will hopefully reduce cases of skin cancer, STI, etc. AOs will also encourage hobbies. |

| 16 |

The National Health Service will be managed and paid for by approved organisations only.

HMG will own the buildings and equipment, but approved organisations will employ the staff

and pay to use the buildings and equipment. Charges to AOs will be identical to that charged

in the USA and UK. The existing private health service in the UK will continue. |

| 17 | National Service will be introduced in defence and emergency positions. Civil Defence will be recreated. In view of the ever worsening defence situation in the Ukraine, it would be unwise to assume it will end amicably. This measure will also instill discipline, positive thinking and risk taking. Qualities that are needed in management, etc. HMG will ultimately sell off its expensive weapon systems (tanks, warships, manned aircraft), concentrating on infantry and space based AI and GPS guided systems. |

| 18 | To reduce the nation's carbon footprint and improve movement particularly for handicapped people, HMG will cease public transport subsidies one year after air taxis and taxi-vans go into mass production in the UK. |

| 19 | In order to finance energy, transport and housing projects listed here, it will be necessary to ensure that the base rate of interest remains as low as possible. It should be born in mind that the Bank of England's base rate has no impact upon the present global inflation in late 2022. Readjustment of the global economy after the Covid-19 pandemic is inevitable. Raising interest rates has far more detrimental effects than advantages. A high interest rate would kill off major projects at birth, ensuring that the global economic downturn lasts far longer, and judging by the existing government debts, it could be permanent. |

| Alphabet/Google | 12,000 |

|---|---|

| Microsoft/Bing | 10,000 |

| Amazon | 18,000 |

| Meta/Facebook | 11,000 |

| Spotify | 600 |

| Yahoo | 1,720 |

| Disney | 7,000 |

| Dell | 6,650 |

| Zoom | 1,300 |

| BT | 55,000 |